Georgia SR22 Insurance

SR22 Insurance in Georgia

A Georgia SR22 car insurance form, sometimes called a SR-22 financial responsibility insurance form, or certificate of responsibility, is a special type of insurance form that shows the Georgia authorities that the driver of a motor vehicle is financially responsible for carrying continuous car insurance with at least the minimum amount of liability coverage for the state. The SR-22 form needs to be filed with the Georgia Department of Motor Vehicles (Georgia DMV) so that they are confident that the driver is covered and can drive safely. The car insurance company and the driver are responsible for filing the SR-22 form with the state.

The first half of the article deals with finding the lowest prices across Georgia, by company, insurance coverage levels, city, and even non-owners. The second part deals with commonly asked Georgia related SR22 insurance questions.

Cheapest Average SR-22 Insurance Companies in Georgia

Overall SR22 Average Rate by Company: Full Coverage

| Company | Average Annual Rate |

|---|---|

| State Farm | $860 |

| USAA | $923 |

| Allstate | $1,119 |

| Country Financial | $1,317 |

| Mercury | $1,411 |

| Progressive | $1,595 |

| Esurance | $1,726 |

| Nationwide | $1,879 |

| MetLife | $2,696 |

| GEICO | $2,982 |

Cheapest Average SR-22 Insurance Companies in Georgia

The following is divided into three sections: by city, by liability, and by full coverage.

Cheapest GA SR-22 Insurance Companies, by City

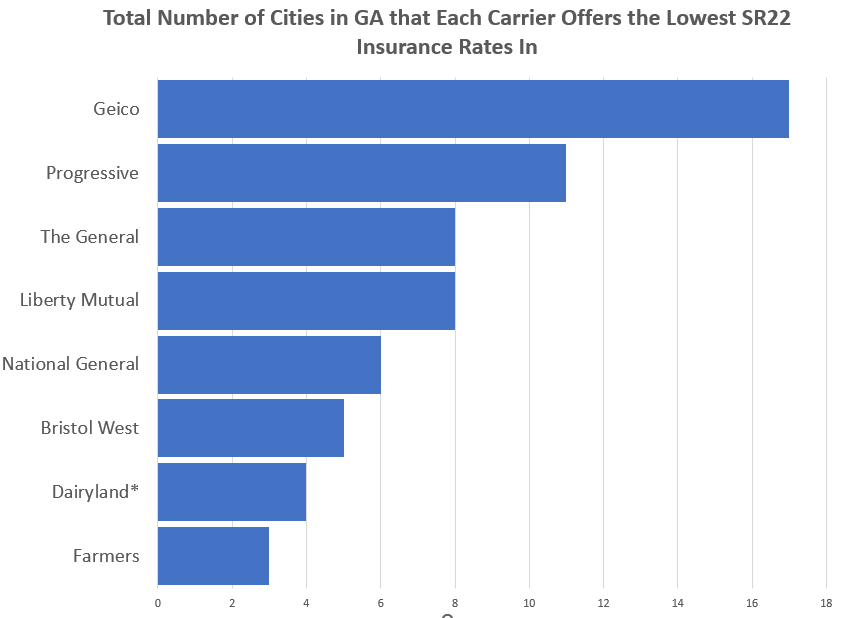

First, a visualization of the data below. GEICO takes the lead, followed by Progressive. In last place Dairland and Farmers. Of course, this is only generalized data and the only way to know who offers the cheapest sr22 insurance in Georgia is to get a quote from us (above).

| City | Price |

|---|---|

| Johns Creek | National General |

| Gainesville | Geico |

| North Druid Hills | Progressive |

| Athens-Clarke County | Liberty Mutual |

| Stonecrest | Liberty Mutual |

| Candler-McAfee | The General |

| Dublin | Geico |

| Americus | Progressive |

| Conyers | Geico |

| Roswell | Geico |

| Mableton | Liberty Mutual |

| Valdosta | The General |

| Fayetteville | Dairyland* |

| Marietta | Geico |

| Evans | Geico |

| Atlanta | Progressive |

| Sandy Springs | Progressive |

| Wilmington Island | The General |

| Alpharetta | National General |

| Redan | National General |

| Newnan | Progressive |

| Brookhaven | Geico |

| East Point | The General |

| LaGrange | The General |

| Tucker | Bristol West |

| Suwanee | Bristol West |

| Snellville | Geico |

| Peachtree Corners | National General |

| Duluth | Liberty Mutual |

| Peachtree City | Geico |

| Tifton | Dairyland* |

| Lawrenceville | Geico |

| Calhoun | The General |

| Augusta-Richmond County | Progressive |

| Sugar Hill | Geico |

| Milledgeville | Progressive |

| Milton | Liberty Mutual |

| Perry | Geico |

| North Decatur | National General |

| Buford | Dairyland* |

| Rome | Progressive |

| Statesboro | Bristol West |

| Kennesaw | National General |

| Warner Robins | Farmers |

| McDonough | Liberty Mutual |

| Decatur | Farmers |

| Albany | Liberty Mutual |

| Macon-Bibb County | The General |

| Dalton | Geico |

| Canton | Progressive |

| Thomasville | Geico |

| Columbus | Geico |

| Forest Park | Farmers |

| Smyrna | The General |

| Pooler | Dairyland* |

| Chamblee | Liberty Mutual |

| St. Marys | Geico |

| Kingsland | Progressive |

| Lithia Springs | Bristol West |

| Savannah | Progressive |

| Martinez | Bristol West |

| Union City | Geico |

Companies with Lowest Cost: Liability Only

You can see below that GAINSCO and AssuranceAmerica tie for first place as having the lowest cost liability SR22 insurance in Georgia at $86, while Farmers Insurance comes in a close second place. On the high side you have Acceptance RTR. Now, recall that we can get you prices on lots of these companies just by filling out the quote form at the top of this page.

| Company | SR22 Liability (average) |

|---|---|

| The General | $107.00 |

| Dairyland | $107.00 |

| Acceptance RTR | $121.00 |

| Farmers | $89.00 |

| State Farm | N/A |

| USAA | N/A |

| GAINSCO | $86.00 |

| State Auto | N/A |

| Nationwide | N/A |

| AssuranceAmerica | $86.00 |

| 21st Century | N/A |

| American Family | N/A |

| Travelers | N/A |

| Mendota Ins. Company | $124.00 |

| Allstate | N/A |

Lowest SR22 Insurance Costs by City (Average): Full Coverage

Chamblee and Peachtree city come in at the average lowest rates: $146 and $148 respectively. Douglasville and Americus came in at the most expensive at $181 and $182.

| City | Price |

|---|---|

| Valdosta | $150 |

| Stonecrest | $180 |

| Douglasville | $181 |

| East Point | $178 |

| Decatur | $176 |

| Lawrenceville | $171 |

| Americus | $182 |

| Mableton | $173 |

| Martinez | $151 |

| North Decatur | $152 |

| Dublin | $158 |

| McDonough | $148 |

| Columbus | $157 |

| Suwanee | $177 |

| Evans | $152 |

| Acworth | $156 |

| Perry | $179 |

| Carrollton | $157 |

| Kingsland | $167 |

| Johns Creek | $160 |

| Athens-Clarke County | $167 |

| Augusta-Richmond County | $172 |

| North Druid Hills | $180 |

| Savannah | $154 |

| Chamblee | $146 |

| Smyrna | $179 |

| Fayetteville | $156 |

| Milledgeville | $158 |

| Candler-McAfee | $150 |

| Thomasville | $175 |

| Alpharetta | $180 |

| Calhoun | $180 |

| Cartersville | $159 |

| Pooler | $164 |

| Stockbridge | $164 |

| Peachtree Corners | $165 |

| South Fulton | $156 |

| Norcross | $175 |

| Statesboro | $162 |

| Hinesville | $164 |

| Rome | $158 |

| Brookhaven | $178 |

| Redan | $175 |

| Peachtree City | $148 |

| Snellville | $153 |

| Duluth | $153 |

| Sandy Springs | $162 |

| Conyers | $153 |

| Brunswick | $154 |

| St. Marys | $164 |

| Forest Park | $165 |

| Newnan | $181 |

| Macon-Bibb County | $174 |

| Albany | $164 |

| Atlanta | $147 |

| LaGrange | $164 |

| Warner Robins | $165 |

| Griffin | $153 |

Full coverage is required for anyone that is driving a leased or financed vehcile. It will not only cover damages when someone hits you, but when you cause an accident, liability only will not cover damages to your own car, so it’s generally suggested that if you have a cheap car, that the full coverage difference in costs can often cost more than the car is worth over time, which is why many choose liability instead. Full coverage however will protect you if you hit any of Georgia’s animals on the road, and commonly hit animals include black bears, brown thrashers, beavers, and armadillos, which can indeed cause accidents or damage to your vehicle.

Lowest SR22 Insurance Costs by City (Average): Liability Only

Sugarville, Tucker and Smyrna came in at the lowest cost in the state at $86/mo. On the most expensive end, Decatur, North Decatur, Milton, and Peachtree Corners averaged $110.

| City | Price |

|---|---|

| Pooler | $90.00 |

| Redan | $103.00 |

| Union City | $106.00 |

| Stonecrest | $105.00 |

| Forest Park | $107.00 |

| Macon-Bibb County | $95.00 |

| Dublin | $104.00 |

| Roswell | $91.00 |

| Kennesaw | $99.00 |

| Fayetteville | $96.00 |

| Johns Creek | $104.00 |

| Smyrna | $86.00 |

| North Druid Hills | $108.00 |

| Athens-Clarke County | $108.00 |

| Milton | $110.00 |

| Mableton | $104.00 |

| Martinez | $101.00 |

| Albany | $106.00 |

| Wilmington Island | $91.00 |

| Candler-McAfee | $96.00 |

| Alpharetta | $101.00 |

| Snellville | $88.00 |

| Canton | $109.00 |

| Griffin | $90.00 |

| Valdosta | $98.00 |

| Conyers | $107.00 |

| Kingsland | $106.00 |

| Tifton | $105.00 |

| Thomasville | $108.00 |

| Woodstock | $93.00 |

| St. Marys | $87.00 |

| Evans | $97.00 |

| Decatur | $110.00 |

| Newnan | $87.00 |

| Acworth | $86.00 |

| Suwanee | $101.00 |

| Sandy Springs | $105.00 |

| Savannah | $97.00 |

| Carrollton | $88.00 |

| Brookhaven | $93.00 |

| Perry | $105.00 |

| Marietta | $91.00 |

| Hinesville | $95.00 |

| Peachtree City | $106.00 |

| Milledgeville | $104.00 |

| LaGrange | $99.00 |

| McDonough | $87.00 |

| Stockbridge | $94.00 |

| Cartersville | $93.00 |

| Peachtree Corners | $110.00 |

| Douglasville | $98.00 |

| Calhoun | $97.00 |

| Columbus | $109.00 |

| Dunwoody | $95.00 |

| Buford | $93.00 |

| South Fulton | $108.00 |

| East Point | $87.00 |

| Chamblee | $107.00 |

| Atlanta | $90.00 |

| Rome | $94.00 |

| Lithia Springs | $109.00 |

| Brunswick | $107.00 |

| Duluth | $99.00 |

| Americus | $89.00 |

| Norcross | $105.00 |

| Sugar Hill | $86.00 |

| Tucker | $86.00 |

| North Decatur | $110.00 |

How Much Are Actual GA SR22 Filing Fees (Company Averages)?

According to Southern Harvest Insurance, companies usually charge between $15 and $25 for filing your SR-22 in Georgia

| Company | Fees |

|---|---|

| Liberty Mutual | $15-$25 |

| 21st Century | N/A |

| USAA | N/A |

| Nationwide | N/A |

| Allstate | Unknown |

| The General | $25.00 |

| Safeco | N/A |

| Geico | $25.00 |

| Acceptance RTR | $25.00 |

| State Farm | Unknown |

| AssuranceAmerica | $25.00 |

| Travelers | N/A |

| Dairyland | Free |

| State Auto | N/A |

| Progressive Insurance | $25.00 |

| American Family | N/A |

Lowest Non-Owner SR-22 Insurance Rates by Company in Georgia

| Company | Average Annual Rate |

|---|---|

| USAA | $530 |

| State Farm | $572 |

| GEICO | $1,043 |

| Progressive | $1,484 |

| Nationwide | $1,905 |

Which Companies & Agencies in GA Offer SR-22 Insurance?

According to our research, the following agencies offer SR-22 coverage in GA, however, just like them, we can give you a quote, but much faster than any of these old school brick and mortars.

Highly rated independent agencies:

- Hamrick

- Good2Go

- Flinsco

- Denton & Tanner

- Freedom

- PeachState

- Schweer

- 1st Option Insurance

- Smiley Insurance Agency

Other carriers and agencies we found that sell sr22 insurance in the state:

- USAA

- AAA

- State Farm

- American Family Insurance

- Grange Insurance

- Progressive Insurance

- Nationwide

- Safeco

- Allstate

- Farmers

- Esurance

- Liberty Mutual

- Direct Auto & Life Insurance Company (Direct General)

- Dairyland

- Acceptance Insurance

- Mercury

- The General

- Safe Auto

- Safeway

- National General

- Assurance America

- Kemper Corporation

- GAINSCO

- Good2Go

- United Automobile Insurance Company (UAIC)

- Jupiter Auto Insurance

- Everest Security

- Mendota Insurance

- Unique Insurance

- Arrowhead

How Much More Does SR22 Insurance Cost Compared to Regular Insurance in GA?

Typical car insurance rates in Georgia hover between $1,300 and $1,400, and SR22 rates are on averaage 10% – 40% more.

How Do I Get the SR-22?

Georgia state law requires all registered drivers to carry car insurance of certain minimum limits. If you fail to carry this coverage, you are breaking the law, and thus might be subject to the SR-22 penalty. Still, even if you have car insurance already, you might have to file for the SR-22 after a qualifying offense such as DUI, reckless driving, and more.

All SR-22 certificates will guarantee that you carry the minimum $25,000/$50,000/$25,000 auto liability insurance coverage required by state law. However, you can often buy more liability coverage, along with collision, comprehensive, uninsured motorist coverage, and more.

How Long Do I Need to Carry SR22 Insurance in GA?

SR-22 penalties last for at least three years in Georgia, and you must keep your auto policy active at all times during this penalty. When you get your SR-22 requirement, you might have to pay for your auto policy in-full at the time you start coverage. This helps ensure you never cause a policy lapse. When your GA SR22 is over it will expire on its own.

What Happens if I Let my SR-22 Coverage Lapse?

If you let your car insurance lapse, so will the SR-22, and that could lead to several additional penalties.

Generally, the Motor Vehicle Department of the State sends out a notification if an SR22 insurance Florida is required. So, if you have not been the recipient of any such information, then it is safe to assume that you do not need to get SR22 insurance.

Violations that require you to get an SR22 in Georgia:

- Been convicted for Driving without insurance

- Been convicted of Driving while under the influence of Alcohol

- Been convicted of serious moving violations

- Been declared a habitual violator

How Long Will I Need an SR-22 in Georgia?

Georgia could require you to maintain an SR-22 or SR-22A for at least three years. This requirement could increase, depending on your driving offense. It can also decrease depending on your driving after the mandate and your level of risk. If you do maintain the SR22, then your insurance company must, by law, report you to the DMV/state to let them know you are in violation, so it’s not unlike parole for people who have recently left jail. After successful completion of the SR22 period, your normal license can be reinstated if it was revoked.

Types of SR-22 Policies in GA (Non-owner SR-22 insurance)

This answers the common question of how to drive someone else’s car when an SR22 is involved. In other words, “do I still need SR22 insurance if I don’t drive?” There are three types of SR-22 certificates in GA:

- Owner’s Certificate

- Operator’s Certificate

- Operator-Owner’s Certificate

Owner’s Certificate

The owner of the car needs an SR-22 Owner’s Certificate that shows his financial responsibility as the owner of the vehicle. This shows the state that should that driver be in an accident in that car, at least the minimum car insurance is in place. This is the certificate that most drivers will have.

It is also possible to get non owner SR-22 insurance in Georgia. If you drive someone else’s car and don’t have non owners insurance, you would be responsible for any damages from an accident you caused.

Operator’s Certificate

The SR-22 Operator’s Certificate proves the financial responsibility of the operator of a vehicle if they do not own it. This would be needed if you do not own your own car but routinely borrow a car from a friend or family member, for example. This is basically the same as a non-owners sr22 insurance policy.

Operator-Owner’s Certificate

There is also an Operator-Owner’s Certificate that covers the driver and all the vehicles they drive, whether or not they own those vehicles. This type of certificate would cover you if you have your own car but sometimes drive someone else’s car, like your parent’s car.

How Much Does an SR-22 Cost in Georgia?

Insurance after an SR-22 in Georgia tends to be expensive. This isn’t a direct cost of the SR-22 — typical filing fees run just $15 to $35 — insurance rate increases with the citation that prompted the SR-22 requirement to begin with.

Why Does Georgia Have an SR-22A (and What is It)?

Georgia is one of a few states that has two types of SR-22s: standard SR-22s and SR22As. The SR-22A is slightly different from the SR-22, in that the SR-22A is for low-level driving offenders, while the SR-22 is for habitual offenders. There are fee differences between the two. An SR-22 is required for drivers who are convicted of three or more violations within a five-year period. More common in Georgia, SR-22As are for drivers convicted of only one or two violations over a five-year period. You might need one if you’re caught driving without insurance or with a suspended license.

Regardless of your driving history, we’re here to help. Ready to get started? Sit back, relax,

and discover an easier way to get the coverage you need.

How Much are Minimum Insurance Limits in GA for SR-22 Drivers?

If you or a family member are driving and involved in a accident the insurance company will pay for damages occurred from the accident up to $25,000. If there is damages above and beyond that you will be responsible for the remaining money owed.

Comments

Comments are closed.