Alabama SR22 Insurance

Cheapest SR-22 Insurance Companies in Alabama

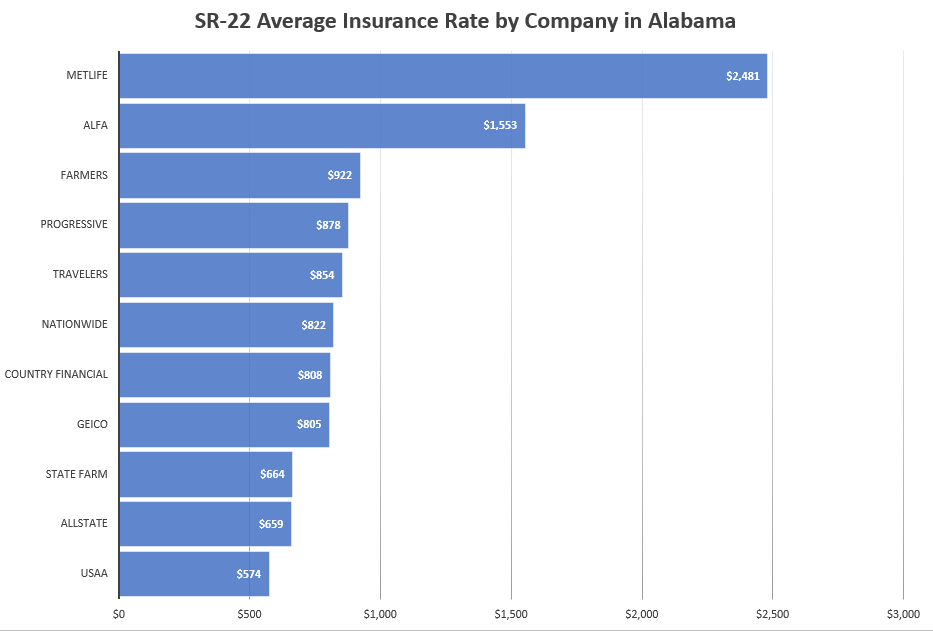

Surely, most people looking for sr-22 insurance are looking for the best rates, but few companies will actually make it easy to price shop, therefore we publish the following data. Please note the data is based on a sample, average driver profile and therefore your individual rate will vary, potentially by a much different rate, which means at the end of the day, you will need to get a quote from us.

SR22 Insurance Rates in AL, by Company

Clearly, Metlife is not competitive at all, and unfortunately, USAA is not available to the general public, but more importantly, since these are averages, the only way to know what your rate will be is to get a quote (above).

| USAA | $574 |

| Allstate | $659 |

| State Farm | $664 |

| Geico | $805 |

| Country Financial | $808 |

| Nationwide | $822 |

| Travelers | $854 |

| Progressive | $878 |

| Farmers | $922 |

| Alfa | $1,553 |

| Metlife | $2,481 |

Cost of SR-22 Insurance with Full Coverage in Alabama by City

| City | Price |

|---|---|

| Daphne | $179 |

| Jasper | $173 |

| Muscle Shoals | $146 |

| Fultondale | $151 |

| Eufaula | $149 |

| Hueytown | $168 |

| Atmore | $175 |

| Jacksonville | $151 |

| Talladega | $174 |

| Northport | $154 |

| Montgomery | $175 |

| Russellville | $171 |

| Homewood | $156 |

| Albertville | $162 |

| Forestdale | $151 |

| Dothan | $163 |

| Fairhope | $178 |

| Saks | $147 |

| Pleasant Grove | $173 |

| Mountain Brook | $177 |

| Rainbow City | $181 |

| Leeds | $160 |

| Clay | $156 |

| Fairfield | $167 |

| Bay Minette | $158 |

| Calera | $167 |

| Millbrook | $177 |

| Tuscaloosa | $165 |

| Gardendale | $171 |

| Selma | $173 |

| Pike Road | $171 |

| Scottsboro | $154 |

| Trussville | $150 |

| Mobile | $170 |

| Valley | $147 |

| Phenix City | $178 |

| Enterprise | $151 |

| Foley | $181 |

| Prichard | $147 |

| Opelika | $175 |

| Oxford | $181 |

| Cullman | $160 |

| Pelham | $172 |

| Decatur | $149 |

| Hoover | $165 |

| Moody | $176 |

| Irondale | $153 |

| Saraland | $173 |

| Alexander City | $159 |

| Pell City | $169 |

| Bessemer | $162 |

| Ozark | $151 |

| Meadowbrook | $161 |

| Gulf Shores | $180 |

| Hartselle | $169 |

| Anniston | $158 |

| Athens | $152 |

| Vestavia Hills | $167 |

| Center Point | $163 |

| Prattville | $150 |

| Auburn | $167 |

| Tillmans Corner | $156 |

| Huntsville | $165 |

| Gadsden | $177 |

| Sylacauga | $178 |

| Madison | $146 |

| Birmingham | $180 |

| Helena | $164 |

| Troy | $172 |

| Alabaster | $162 |

| Fort Payne | $162 |

| Chelsea | $164 |

| Sheffield | $155 |

| Boaz | $149 |

Cheapest SR-22 Insurance Companies Alabama, by City

| City | Price |

|---|---|

| Muscle Shoals | Geico |

| Valley | National General |

| Talladega | Geico |

| Chelsea | Liberty Mutual |

| Huntsville | The General |

| Moody | The General |

| Birmingham | Liberty Mutual |

| Mountain Brook | Progressive |

| Tuscaloosa | Progressive |

| Pelham | The General |

| Troy | The General |

| Pleasant Grove | The General |

| Trussville | Liberty Mutual |

| Dothan | The General |

| Prattville | Geico |

| Bay Minette | Farmers |

| Daphne | Geico |

| Alabaster | Progressive |

| Leeds | Geico |

| Sheffield | Dairyland* |

| Helena | Progressive |

| Gadsden | Bristol West |

| Alexander City | Liberty Mutual |

| Northport | Progressive |

| Saraland | Geico |

| Pell City | Dairyland* |

| Irondale | Bristol West |

| Albertville | Liberty Mutual |

| Vestavia Hills | Progressive |

| Millbrook | Liberty Mutual |

| Hartselle | Progressive |

| Homewood | The General |

| Decatur | Geico |

| Prichard | National General |

| Jacksonville | Geico |

| Gardendale | Progressive |

| Gulf Shores | Progressive |

| Bessemer | Dairyland* |

| Saks | Progressive |

| Meadowbrook | The General |

| Foley | The General |

| Enterprise | The General |

| Russellville | Bristol West |

| Hoover | The General |

| Fairfield | Progressive |

| Atmore | Progressive |

| Fultondale | Progressive |

| Cullman | National General |

| Boaz | Progressive |

| Pike Road | Progressive |

| Calera | Bristol West |

Need a quick quote on SR-22 insurance? Check your city above to find the most affordable Insurance company. Many of these companies specialize in SR-22 Insurance in Alabama filings and are able to offer cheaper prices.

SR-22 Insurance Rates by Company in Alabama

The following represents averages based upon our sample customer profile.

Liability Only

| Company | SR22 Liability (Average) |

|---|---|

| Acceptance RTR | $98.00 |

| Assurance America | $93.00 |

| The General | $115.00 |

| GAINSCO | $71.00 |

| Bristol West | $86.00 |

| Travelers | N/A |

| Mendota Ins. Company | $80.00 |

| National General | $83.00 |

| Safeco | N/A |

| USAA | N/A |

| Geico | $86.00 |

| Nationwide | N/A |

| American Family | N/A |

| State Farm | N/A |

| Liberty Mutual | $97.00 |

| Farmers | $112.00 |

| Allstate | N/A |

| 21st Century | N/A |

Full Coverage

| Company | SR22 Full Coverage (Average) |

|---|---|

| Mendota Ins. Company | $191.00 |

| Nationwide | N/A |

| State Auto | N/A |

| Liberty Mutual | $202.00 |

| American Family | N/A |

| State Farm | N/A |

| GAINSCO | $203.00 |

| Bristol West | $174.00 |

| National General | $210.00 |

| The General | $167.00 |

| Acceptance RTR | $182.00 |

| AssuranceAmerica | $206.00 |

| 21st Century | N/A |

| Farmers | $216.00 |

| Allstate | N/A |

SR-22 Non-Owner Insurance Rates by Company in Alabama

As mentioned previously, these represent averages.

| Company | Rate |

|---|---|

| GEICO | $294 |

| USAA | $341 |

| Travelers | $476 |

| Progressive | $760 |

| Farmers | $879 |

| State Farm | $1,533 |

Which Companies Offer SR22 in Alabama?

| Company | SR22 Offered |

|---|---|

| American Family | no |

| Progressive Insurance | yes |

| State Farm | unsure |

| Bristol West | yes |

| Dairyland | yes |

| 21st Century | no |

| Travelers | no |

| Geico | yes |

| Nationwide | no |

| USAA | yes |

| Safeco | no |

| Liberty Mutual | yes |

| Acceptance RTR | yes |

| Allstate | unsure |

| Mendota Ins. Company | yes |

| AssuranceAmerica | yes |

| National General | yes |

| The General | yes |

| Farmers | yes |

| State Auto | no |

Many companies do not offer SR-22 insurance because they are considered for ‘high risk’ drivers. High-risk drivers are often avoided by insurance companies, while other companies actively pursue them. It is a little known fact that Progressive got its start large in part due to its pursuing SR22 policies. Other insurance brokers include companies like Select Insurance Group, Serenity Insurance, Wessel Insurance, the Zebra, Ultra, and other small agencies.

Other brokers we found in the state that may offer SR-22 include:

- Alabama Insurance Center

- Alabama Insurance Agency

- Direct Auto Insurance

- Affordable Insurance Agency

- Alfa Insurance

- Direct General Insurance

- Auto-Owners Insurance

- The Insurance Shop

- The Insurance Place

- The Insurance Mart

[Methodology: The rates were based on non-owner car insurance using a sample driver profile who had a DUI in Alabama with the following limits: $50,000 in bodily injury liability per person, up to $100,000 per accident and $50,000 in property damage liability per accident.]

SR22 Insurance Form in Alabama

An SR22 form is a document often required by a state’s Department of Motor Vehicles (DMV) proving that a driver is carrying the state’s required minimum amount of vehicle liability insurance. SR22’s are typically needed for a driver to reinstate their driver’s license and therefore driving privileges after an offense such as a DWI/DUI conviction or uninsured auto accident. So, SR-22 insurance is not actually an insurance type, but a policy that works for drivers who have an SR-22.

If your driver’s license has been suspended or revoked due to any of the following offenses or if you are involved in any of the following conditions, the state of Alabama may require you to submit an SR-22 insurance filing in order to reinstate your driving privileges.

- Driving without auto insurance

- Driving with a suspended or revoked license

- Accumulating too many points against a driving record

- DUI or DWI offense

- You have been convicted of driving or being in actual physical control of any vehicle while under the influence of alcohol or under the influence of a controlled substance.

- Reckless driving

- Refusal to test for DUI or DWI

- Uninsured accidents

- Child support or neglect cases

- Legal judgments

- Manslaughter or homicide by vehicle.

- You have been convicted of a felony in the commission of which a motor vehicle is used;

- You failed to stop, render aid, or identify yourself in a motor vehicle accident resulting in the death or bodily injury of another.

- You committed perjury or the making of a false affidavit or statement under oath to the Director of Public Safety.

- You have been convicted upon three charges of reckless driving committed within a period of 12 months.

- You have been convicted of unauthorized use of a motor vehicle belonging to another.

In the state of Alabama, your driver license can be suspended either administratively by the Alabama Law Enforcement Agency (ALEA) or by court order for the following reasons:

- You have committed an offense for which mandatory revocation of license is required upon conviction. For example: you have been arrested for driving while under the influence. The ALEA can suspend your license pending the resolution of your case as a conviction would cause your license to be revoked.

- You have been convicted with such frequency of serious offenses against traffic regulations governing the movement of vehicles as to indicate a disrespect for traffic laws and a disregard for the safety of other persons on the highways. Alabama assigns a point value for moving violations and your license is subject to being suspended if you are assigned a specific number of points over a two year period.

How much does an SR-22 cost in Alabama?

If you need SR22 insurance, you get placed into the high-risk or non-standard driver category, which affects your car insurance rates. High-risk drivers typically pay the highest car insurance rates. In addition to your driving record, there are many other things that help determine your SR22 car insurance rates, including the company you choose, your age, gender, location, credit score, vehicle type, marital status and so on.

One of the most common reasons drivers need SR-22 insurance is because of a DUI. On average, drivers with one DUI conviction in Alabama pay $1,919 per year for car insurance. That’s 55 percent more than car insurance for a driver with a clean driving record. However, the cost you pay differs significantly based on the company you buy car insurance from.

Alabama SR-22 requirements

Do you need to file an SR-22 form in Alabama? An SR-22 is a certificate of financial responsibility that proves to Alabama that you have the minimum liability insurance mandated by law. If your license was suspended or revoked, you may need to file an SR-22 before you can apply to get it reinstated.

If you’re required to have SR22 insurance, you’ll be required to maintain your SR22 insurance for a specified number of years in Alabama.

The property damage will provide coverage for the driver and whomever is driving the vehicle in the case of an accident.

If you or a family member are driving and involved in a accident the insurance company will pay for damages occurred from the accident up to $25,000. If there is damages above and beyond that you will be responsible for the remaining money owed.

SR-22 Insurance Limits in Alabama

An Alabama SR22 insurance policy verifies to the state that you have at least the minimum amount of liability insurance coverage required by law.

- $25,000 for bodily injury per person – is for the occurrence of a serious or permanent injury that someone sustains while in an accident with you driving.

- $50,000 for bodily injury per accident – This is the maximum payout and must be divided among the individuals involved in the accident. If another person tries to sue you regarding the accident, the insurance company will provide the legal representation for you in court to handle all problems that arise from it.

- $25,000 for property damage per accident – The property damage will provide coverage for the driver and whomever is driving the vehicle in the case of an accident. If you or a family member are driving and involved in an accident, the insurance company will pay for damages incurred for up to $25,000. If there are damages above and beyond, you will shoulder that out of your pocket.

How Long Do I Need to Carry SR22 Insurance in Alabama?

Typically, SR-22 is required for three years at a minimum, although the length of filing the form depends on the nature of the offense. You must maintain your SR22 insurance coverage continuously throughout your filing period without a lapse in coverage.

Alabama requires an SR-22 for a minimum of three years — usually for driving without insurance. When you’re convicted of a DUI, you could need to file an SR-22 for up to five years. The state can choose to reduce your requirement to 36 months if you keep your record clean and your insurance is up to date for the first 3 years.

If you fail to pay on your policy, the state will revoke your SR-22. Your insurance company is forced to file an SR-26 with the DMV, and your license is suspended until a new SR-22 is filed. Don’t make a complicated situation worse by missing payments or not renewing your insurance policy. Failing to pay your insurance or renew your SR-22 coverage could reset the clock on your filing period and put you right back to square one.

Even if you don’t own a vehicle, you’ll need insurance if your driver’s license has been suspended or revoked – you will need to buy non-owner SR-22 insurance to have your driver’s license reinstated, and you will need to be covered by SR-22 if you occasionally drive a vehicle owned by someone else.

Different Types of Alabama SR-22 Insurance Forms

Alabama has two types of SR-22 car insurance forms:

- Owner SR-22 insurance

- Non-owner SR-22 insurance

- Owner SR-22 insurance

A standard auto insurance policy on a vehicle titled in your name with the state of Alabama, with an SR-22 certificate of financial responsibility attached. This insurance form are given to driver’s who currently own the vehicle.

Non-owner SR-22 insurance

Non owner SR22 insurance Alabama is a high risk insurance certificate for license reinstatement. It is for people who don’t own a car, but need to be insured when driving a borrowed car on occasion. Rather than insuring a vehicle, it insures the policyholder when they drive a non-owned vehicle. Non owner SR22 insurance pays claims if claims exceed the vehicle owner’s insurance coverage.

If your license is suspended and you don’t own a vehicle, you’ll need non owner SR22 insurance Alabama to reinstate your license. It’s illegal in Alabama to drive without minimum liability insurance coverage, even if you don’t own a vehicle. SR22 insurance is required for Alabama license reinstatement, Further, it is a guarantee to the state that if you drive a borrowed vehicle, you’re properly insured if you cause an accident.

Alabama DUI laws and SR-22 Insurance

In Alabama, the legal blood alcohol limit is 0.08% (0.02% for underage drivers). If you are caught operating a motor vehicle with a blood alcohol level above the limit, you will be charged with a DUI. If you are convicted, your driver’s license will likely be suspended or revoked.

- First conviction – 90 day suspension

- Second conviction in 5 years – 1 year revocation

- Third conviction – 3 year revocation

- Fourth or subsequent conviction – 5 year revocation

Alabama has an Implied Consent Law. This means that if you operate a motor vehicle on the roads in Alabama, you are accepting the fact that, if asked to do so, you will be required by law to submit to a blood alcohol test. Refusing to submit to a blood alcohol test will automatically result in a conviction and a suspension of your driver’s license.

In order to get your driver license reinstated after it has been suspended or revoked, you will need to pay a reinstatement fee of $275. You will also need to purchase an AL SR22 insurance policy.

Bottom line

After losing your license, being convicted of a DUI or getting caught without insurance, you can file for SR-22 coverage to get back on the road. You’ll need to prove to the state of Alabama that you’re covered by the state’s minimum car insurance requirements for three to five years.

Once you’re no longer required to have SR-22 insurance, you might see your car insurance premiums go up, but it’s worth it to know your driving record is getting back on the right track. Even after an SR-22, you’re not without options for car insurance coverage. Compare car insurance providers to get an idea of which providers have the best options for your situation.

Get Insured Today

SR-22 Insurance is working every day to help Alabama drivers obtain the coverage they need to legally drive. We work with many customers seeking high-risk Alabama SR-22 insurance at the lowest possible rates. If you suspect that your current or previous auto insurance company has been overcharging you, allow us to show you a quote that you’ll love.

Get a FREE auto insurance quote above, or give us a call to discuss setting up a new policy over the phone.

Comments

Comments are closed.